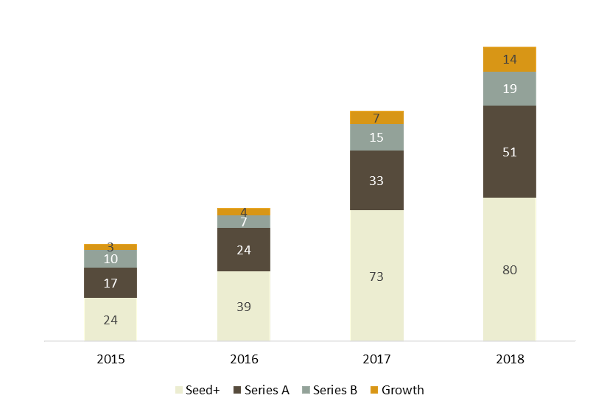

African start-ups are finally coming of age. Last year, nearly 100 companies raised $1m+ , and activity is up 300%+ in the 4 years to 2018, according to Partech Ventures.

2019 was a new record, with tech investments up to $2B according to Partech. Interestingly, that’s equivalent to about $12B in ‘Western’ funding, because each dollar buys so much more in Africa. $12B is already more than a quarter of Europe’s $40B fund total, and Africa is ‘catching up’ incredibly fast.

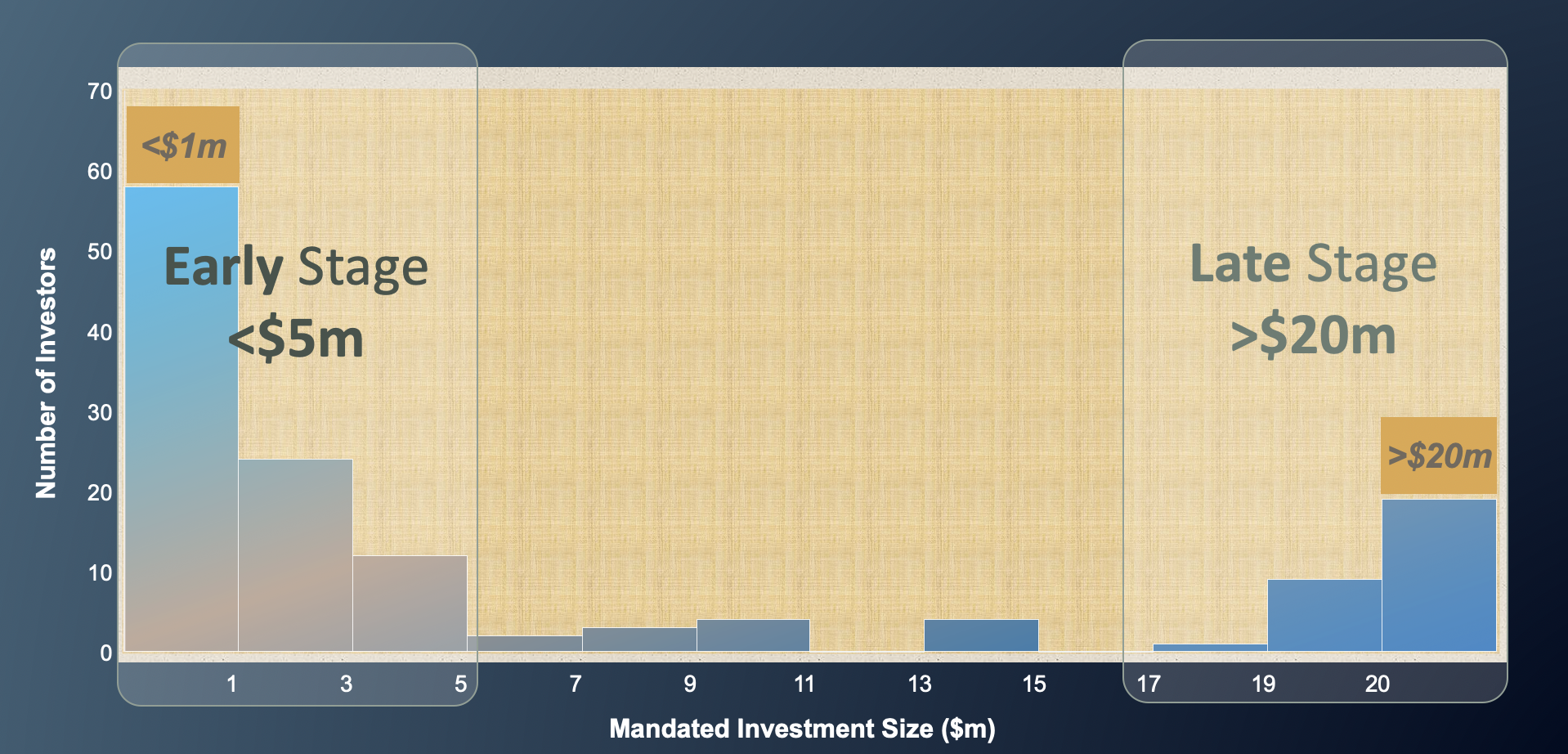

But there is a yawning gap waiting for these companies as they try to scale. While Africa has its share of early stage and private equity funds, there is very little money in the ‘growth stage’ between. Early stage investors usually invest up to $3-4m in businesses with low revenue, while at the other end private equity looks for profitable businesses already larger than $20m+ of revenue. In between, growth capital backs companies with $10m+ of revenue, often still losing money but growing 50%+. It is nearly impossible for businesses to scale to leadership size without this growth capital.

Yet there are virtually no African growth funds to fill this gap. At Magister, we analysed 250 investors who have been active in Africa in the last few years and looked at what each fund states as their ‘sweet spot’ for investment. We found a ‘growth gap’ far bigger than we had expected, especially in the $5-20m investment size:

This is not a huge problem today, though it is already more challenging for African companies raising $10m+ to get rounds done quickly and efficiently. But it could become the biggest funding issue just three years from now, as today’s fledgling businesses look to raise $10m+ to grow to $30-50m+ of revenue.

Let’s look at simple ‘cohort math’. In the US and Europe 40% of businesses raising $1m go on to raise Series A, and 25% go on to raise Series B. Applying those percentages to Africa, of last year’s 100 African businesses raising $1m+, 25 will be worth backing with $10-20m+ equity investments. Roll that forward over the next 4 years and we will have 100 African companies capable of raising $15m+ growth rounds. This means there will be an abundance of start-ups qualified to raise growth capital and virtually no funds to support them.

You can look at this in two ways. It could be a disaster waiting to happen, that stalls Africa’s entrepreneurial sector in Africa just when it is beginning to really motor. Or it could be a huge opportunity for a group of specialist growth funds that fill this yawning gap.

We believe nature will abhor this vacuum. But given the time required to create and raise African funds in general, it’s critical that 2020 already see major investment groups create vehicles to fill this gap. For those that do, there will surely be a huge and growing market opportunity of quality companies to back in the next few years.

As ever if you enjoyed this article please ‘like’ and share, thank you.